what is hospital indemnity high plan

A hospital stay can be expensive and can happen at any time. However there are plans that cover even more.

Insurance Securian Accident And Hospital Insurance

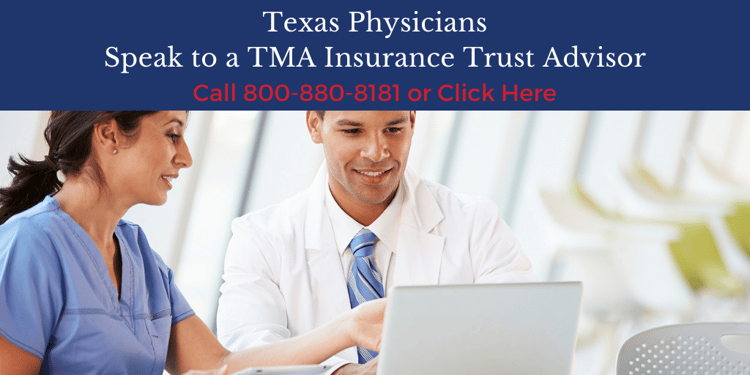

Dedicated help line to answer your health plan questions.

. Health insurance plans are offered andor underwritten by Aetna Life Insurance Company Aetna. Seeing how easy it is to sign up for and utilize this benefit will allow employees to find peace of mind. It provides a fixed benefit amount to help cover expenses and.

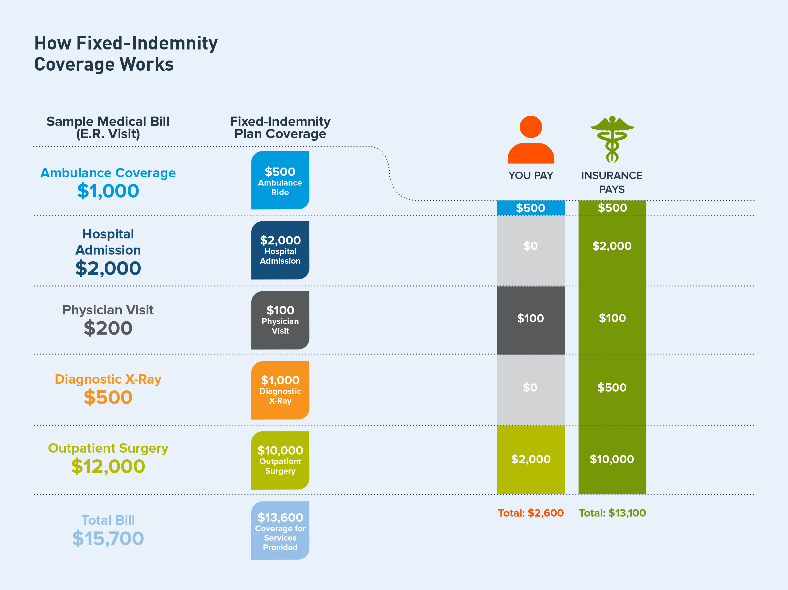

Hospital stays can cost patients thousands of dollars in out-of-pocket fees even with health insurance. Typically plans pay based on the number of days of hospitalization. Even with medical coverage out-of-pocket expenses such as deductible costs rehabilitation and transportation can add up quickly.

Hospital indemnity plans are especially beneficial for those with high deductible insurance plans. Hospital indemnity insurance is an insurance plan you can purchase in addition to your health insurance plan sponsored by your employer the government or a private insurer. Coverage for hospital admission accident-related inpatient rehabilitation and hospital stays 1.

Their hospital indemnity provides 1500 for the hospital admission. You or the provider sends the bill to the insurance company which pays part of it. For example Monday-Tuesday 1 day Tuesday-Wednesday 1 day.

Additionally you can receive 3000 lump. Prepare for the unexpected with a Hospital Indemnity Insurance policy. Premiums increment as policyholders age and add relatives.

Please feel free to call us at 866-966-9868 if you have questions about Hospital Indemnity Plans. Hospital Indemnity plans are typically paid for on a monthly basis. Hospital confinement with or without surgery Intensive Care Unit ICU confinement.

With an indemnity plan sometimes called fee-for-service you can use any medical provider such as a doctor and hospital. The benefits may vary from the coverage your employer is offering. For example a 30-year-old individual with a 100-per-night hospital indemnity plan can expect to pay less than 5 per month to maintain coverage.

Premiums increase as policyholders age and add family members. But you can with hospital indemnity insurance. This scenario illustrates 1100 for First Day Hospital Confinement and 100 for Daily Hospital Confinement for days 2 and 3.

Hospital indemnity insurance is meant to supplement your medical insurance not replace it so its as important to understand what it wont cover as what it will. So lets say you have a 6500 deductible on your health insurance plan and are responsible for 30 coinsurance. Health benefits and health insurance plans contain exclusions and limitations.

It wont pay medical bills from your doctors or hospitals nor will it pay for your medications from the pharmacy. The Union Plus Hospital Indemnity Insurance Plan supports your basic health insurance plan and pays you money each day youre hospitalized for a covered sickness or injury. As deductibles co-pays and co-insurance rise many employees are worried about increasing out-of-pocket costs.

We offer both HSA 5 and non-HSA-compatible HI plan designs. You pay a monthly. Depending on the plan hospital indemnity insurance gives you cash payments to help you pay for the added expenses that may come while you recover.

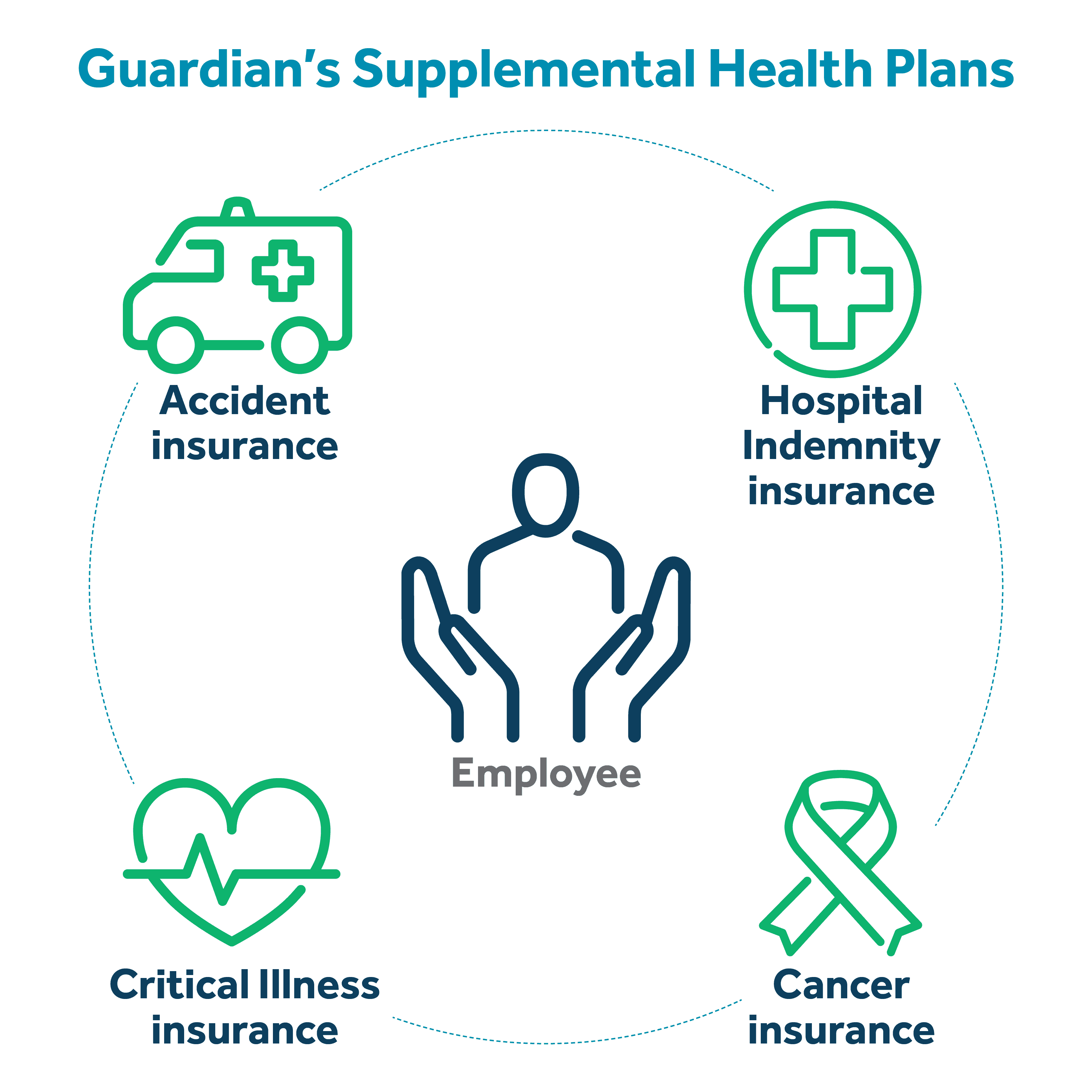

Some hospital indemnity coverage also. Guaranteed acceptance for you and eligible family members 2. The supplemental plans listed below can be applied for individually and premiums can be paid on.

The coverage your hospital indemnity insurance provides will depend on your plan selection. Gain peace of mind amidst high healthcare costs. Guardians Hospital Indemnity benefit can help pay for out-of-pocket costs associated with being hospitalized in addition to your medical coverage and can give you more of a financial safety net for unplanned expenses brought on by a hospital stay.

Usually you have a deductiblesuch as 200to pay each year before the insurer starts paying. By contrast a 55-year-old family man with a 250-per-night plan might pay up to 40 or more. Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance.

For language services please call the number on your member ID card and request an operator. If you stay overnight at the hospital your indemnity insurance will payout the pre-set amount. Its a pretty black and white arrangement.

Usually you have a deductiblesuch as 200to pay each year before the insurer starts paying. Also known as hospital confinement indemnity insurance or simply hospital insurance it is considered a type of supplemental health insurance. The average price of a hospital stay for seniors is nearly 15000 for a five-day visit.

Every hospital indemnity insurance plan is different but Aflacs hospital insurance pays the policyholder cash benefits unless otherwise assigned. While it cant make you stop worrying. Portable coverage should you decide to leave your current employer 3.

Optional benefits like coverage for medical-related travel expenses or expenses incurred for family care. Conversely a 55-year-old family man with a 250-per-night plan may settle up to 40 or more. Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

You dont think you can downgrade. Hospital Indemnity insurance can help lower your costs if you have a hospital stay. Payments are made directly to you even if you did not actually incur any out-of-pocket expenses.

Your individual experience may also vary. Hospital expenses average nearly 4000 a day with a typical hospital stay costing more than 15000 total. You may choose to use the benefit payments you receive from a.

If you currently offer or are considering moving toward a high-deductible health plan Hospital Indemnity Insurance is a cost-effective way to round out your coverage options. A day is 24 hours and indicates an overnight stay. With an indemnity plan sometimes called fee-for-service you can use any medical provider such as a doctor and hospital.

An additional 200 per day would be provided. As an additional option you can likely use it to pay any. While Medicare may cover some of this it wont cover the entire cost.

As part of our base plan our guaranteed issue 4 Hospital Indemnity HI insurance provides a competitive range of first day confinement and daily confinement benefit amounts. For instance a 30-year-old individual with a 100-per-night hospital indemnity plan can hope to pay under 5 each month to look after coverage. These plans can still help financially protect you if youre faced with high hospital bills.

Since hospital indemnity insurance is a sum of money paid to you relative to the terms of your plan providers cannot deny your insurance. Critical Care Unit CCU confinement. For complete details of the best plan for you and your family talk to your companys.

That means its designed to complement traditional health. And the cost is 399 per month which is 253 less than your current plan. Ad Preventive screenings included in all health plans.

Some plans offered by Health Benefits Connect can be purchased by a simple online application without medical underwriting. The total benefit for this three-day stay would be 2100 paid directly to the employee. 247 telehealth plus nurse hotline.

In general most plans cover. Large and trusted networks. You or the provider sends the bill to the insurance company which pays part of it.

One hospital indemnity plan we work with contains a 6350 lump sum hospital admission benefit and a daily hospital benefit of 200 per day. A hospital indemnity plan can work for most people. How does an indemnity plan work.

Ushealth Group Inc Is A Healthcare Group Which Provides High Quality Healthcare Insuran Best Health Insurance Individual Health Insurance Life Insurance Sales

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Sun Life

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

Hospital Indemnity Insurance Through Our Fmo Senior Market Advisors

4 Facts You Need To Know About Hospital Indemnity Insurance

The Value Of Hospital Indemnity Insurance L Guardian

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

Hospital Indemnity Vs Accident Insurance Sbma Benefits

Professional Indemnity Insurance Professional Indemnity Insurance Indemnity Insurance

4 Facts You Need To Know About Hospital Indemnity Insurance

Car Insurance Group Nissan X Trail 2021 Group Insurance Car Insurance Nissan

Hospital Indemnity Insurance The Hartford

Making Hospital Indemnity Part Of The Mix Guardian

Kemper Health Hospital Indemnity Insurance

Why Hospital Indemnity Insurance Should Be Part Of Every Coverage Portfolio Allstate Benefits

How Hospital Indemnity Insurance Works Guardian

What Is Hospital Indemnity Insurance Forbes Advisor